TaxSlayer

File your taxes

Description of TaxSlayer: File your taxes

TaxSlayer is a tax preparation application designed to help users file their federal and state taxes efficiently. Available for the Android platform, this app offers a user-friendly interface that allows individuals to manage their tax returns conveniently. Users can download TaxSlayer to access various tools and resources aimed at maximizing their tax refunds.

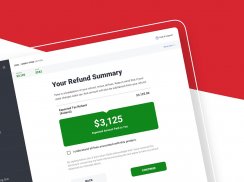

The application guarantees users the maximum refund they are entitled to, and if users do not receive their expected refund, TaxSlayer promises to refund the applicable purchase price. This assurance provides a level of confidence for users throughout the filing process. TaxSlayer is known for its affordability, offering a free filing option called Simply Free, which allows users to file both federal and state returns at no cost if they qualify. For those who do not meet the criteria for the free option, TaxSlayer provides various affordable plans that cater to different tax situations.

TaxSlayer simplifies the tax filing experience by allowing users to upload their prior year returns and import W-2 forms seamlessly. This autofill feature reduces the time and effort needed to input data manually. The application maintains up-to-date calculations to ensure accuracy, and it comes with a 100% accuracy guarantee, offering users peace of mind as they complete their tax returns.

Throughout the filing process, TaxSlayer guides users step-by-step, making the experience more manageable and less daunting. The app includes free, unlimited phone and email support, ensuring that assistance is readily available for users who may have questions or require additional help. For those needing more comprehensive support, TaxSlayer offers services like Ask a Tax Pro and Audit Defense, providing various levels of assistance based on user needs.

TaxSlayer also emphasizes the importance of security when handling sensitive financial information. The app uses encryption and other security measures to protect users' data, ensuring that personal and financial details are kept safe during the filing process. Users can feel confident that their information is secure while using the application.

The app's design is focused on accessibility, allowing users to file their taxes from their smartphones or tablets anytime, anywhere. This flexibility caters to individuals with busy schedules, providing a practical solution for managing their tax obligations. TaxSlayer's mobile compatibility means that users can complete their tax returns on the go, adding convenience to the filing process.

In addition to its core features, TaxSlayer offers various resources to help users better understand their tax situation. The app includes a knowledge base with articles and FAQs that cover common tax-related questions. This educational component empowers users to make informed decisions regarding their tax filings.

For users concerned about the cost of tax preparation, TaxSlayer provides an option to deduct the cost of its products and services from their federal tax refund, allowing individuals to file without paying anything out of pocket. This financial flexibility can be particularly beneficial for those on a tight budget during tax season.

The app is also designed to accommodate a range of tax situations, including self-employment and investment income. TaxSlayer provides specific tools and resources tailored to help users navigate these complexities, ensuring that they can accurately report their income and claim any eligible deductions.

TaxSlayer stands out in a crowded market of tax preparation apps by offering a combination of affordability, support, and user-friendly features. The app's commitment to maximizing refunds and ensuring accurate filings caters to a wide range of taxpayers, from those with straightforward returns to individuals with more complex financial situations.

With its straightforward approach to tax preparation and dedication to customer service, TaxSlayer is a valuable resource for anyone looking to efficiently manage their tax filings. Users can download TaxSlayer today to take advantage of its comprehensive features and support systems, making tax season a less stressful experience.

For more information regarding the IRS, visit https://www.irs.gov. For state and local tax authorities, you can find additional information at https://support.taxslayer.com/hc/en-us/articles/360015711652-State-Contact-Information.